How Whale Accumulation Points to Bitcoin’s $106,000 Breakout

Bitcoin (BTC) is poised to succeed in important value milestones in 2025, backed by optimistic forecasts from Matrixport, Willy Woo, and different establishments.

With help from ETFs and a constructive market sentiment, Bitcoin is a speculative asset and a promising long-term funding choice. Nonetheless, if the worthwhile provide exceeds 90%, the market should stay cautious of potential corrections.

Quite a few Optimistic On-Chain Metrics

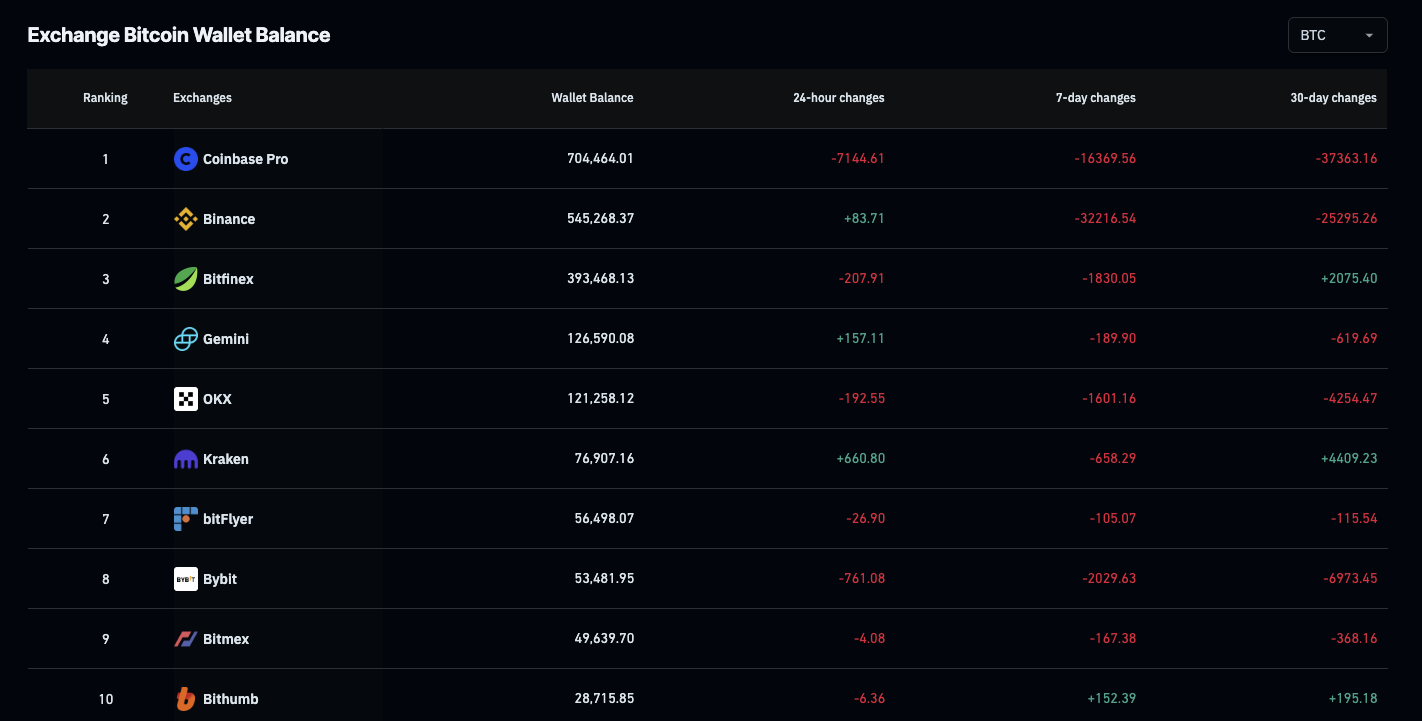

The Bitcoin market is displaying encouraging indicators as the provision on centralized exchanges (CEX) has dropped to a 7-year low. Based on knowledge from CryptoQuant, solely about 2.492 million BTC stay on exchanges. It is a sharp drop from 2.488 million BTC, recorded on the earlier Friday.

Furthermore, CryptoQuant studies that the share of Bitcoin’s provide in revenue has surpassed 85%, a traditionally excessive determine. Nonetheless, they warning that if this ratio exceeds 90%, the market could enter a “historic euphoria” section and face a correction. This implies that whereas the present metrics are favorable, vigilance is required to navigate potential volatility.

Over the previous seven days, Coinglass knowledge recorded roughly 56,164.88 BTC being withdrawn from CEX platforms. This means that traders are accumulating and lowering promoting stress, which is usually seen as a bullish sign. A diminished provide on exchanges lowers promoting stress, paving the way in which for value progress.

Moreover, new capital influx into the market is rising. Based on a CoinShares report, $3.2 billion poured into Bitcoin funds within the final week of April 2025. These components are bolstering confidence that Bitcoin may quickly hit important value targets.

Specialists’ Optimistic Forecasts for BTC

Amid a usually optimistic market outlook, quite a few consultants and organizations have expressed positivity concerning BTC’s value. Matrixport, a good crypto service platform, asserts that Bitcoin’s upward momentum is gaining energy.

In its latest analysis, Matrixport indicated that Bitcoin is approaching the $106,000 resistance stage, with a robust chance of breaking by way of this mark quickly. Beforehand, Matrixport had predicted that new capital inflows into the market would propel Bitcoin previous the $100,000 threshold.

This evaluation is additional supported by whales’ subtle yet significant accumulation, excessive greed sentiment, and high optimism, which have introduced BTC nearer to the $100,000 mark.

Willy Woo, a famend analyst within the crypto business, additionally shared an optimistic view on X. He believes that Bitcoin’s fundamentals have shifted to a bullish state, with the market more likely to both transfer sideways or rise slowly within the coming interval.

“BTC fundamentals have turned bullish, not a nasty setup to interrupt all-time highs,” he stated.

Woo emphasised that the “bullish ascending triangle” sample he beforehand talked about is forming, signaling a possible sturdy upward transfer if Bitcoin breaks by way of the resistance stage.

Moreover, a Coinness report revealed that 45.4% of South Korean traders imagine Bitcoin will outperform gold within the subsequent six months. It displays sturdy confidence from a key Asian market.

Moreover, as reported by BeInCrypto, ARK Make investments predicts that Bitcoin’s value may attain $2.4 million by 2030, pushed by the expansion of Bitcoin ETFs and growing adoption by monetary establishments. These long-term forecasts additional reinforce the assumption that Bitcoin’s potential extends far past the $100,000 mark, with important progress prospects sooner or later.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

Source link