Ripple Price To $8 by 2026, Standard Chartered

Welcome to the US Crypto Information Morning Briefing—your important rundown of crucial developments in crypto for the day forward.]

Seize a espresso as we delve into market sentiment about XRP ETFs (exchange-traded funds) within the US. As prospects for this monetary instrument proceed to develop, consultants have weighed in on the potential affect on Ripple’s XRP token.

Crypto Information of the Day: XRP ETF Inflows to Attain $8.3 Billion, Customary Chartered Predicts

There was a lot chatter this week in crypto about XRP ETFs, starting from false rumors and reviews to delays in key decisions. Nonetheless, one factor seems sure: the dialog is rising greater than ever.

The latest determination to approve ProShares leveraged futures XRP ETF supplied optimism; now, anticipation is constructing.

In a latest US Crypto News publication, ETF analyst Eric Balchunas indicated they’ve raised their odds to 85%. Based mostly on this, analysts supply diverging outlooks on how such a product may carry out.

“XRP worth may rise to $12.23 or $22.20 after ETF Approval if XRP ETFs Get 15% to 30% of Bitcoin ETF Inflows,” a preferred account on X shared.

BeInCrypto knowledge exhibits that XRP was buying and selling for $2.22 as of this writing, down by nearly 1% within the final 24 hours.

Towards this backdrop, BeInCrypto contacted Customary Chartered for a commentary. The financial institution’s head of digital belongings analysis, Geoff Kendrick, stated it was difficult to foretell exact influx figures.

Nonetheless, he indicated that comparative knowledge from Europe may present some steering.

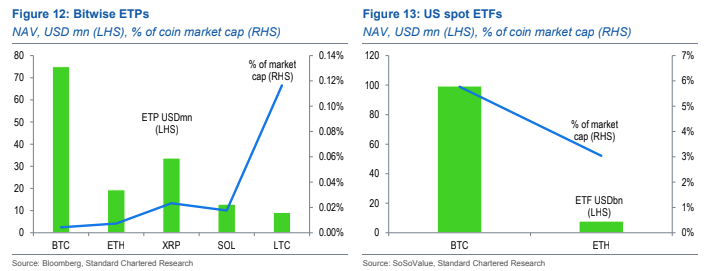

“The quantity of eventual inflows to XRP ETFs is tough to estimate. Nonetheless, Bitwise has listed ETPs in Germany for XRP, Solana, Litecoin, BTC, and ETH, which can present an apples-for-apples comparability,” Kendrick informed BeInCrypto.

Drawing on his prediction of how an XRP ETF may carry out and the related affect on XRP worth, Kendrick in contrast Bitcoin, Ethereum, and different altcoins.

Citing Bitwise knowledge, the Customary Chartered government famous that altcoins garner a bigger proportion of ETP (exchange-traded product) internet asset worth (NAV) as a proportion of coin market capitalization than Bitcoin and Ethereum.

Nonetheless, he acknowledged that this might be as a result of fewer ETPs can be found for altcoins. Kendrick added that NAV-to-market-cap ratios from already approved US spot ETFs present a helpful benchmark.

Based mostly on these assessments, Geoff Kendrick projected {that a} US-listed spot XRP ETF may entice as a lot as $8.3 billion in inflows inside its first 12 months.

“Of the US spot ETFs permitted to this point, NAV as a proportion of market cap is 3% for Ethereum and just below 6% for Bitcoin. At present XRP market cap, that might indicate a spread of $4.4 billion to $8.3 billion as a future complete NAV measure for an XRP ETF, which looks like an inexpensive goal vary for inflows within the first 12 months,” Kendrick added.

Kendrick Sees Ripple Value at $8, Bitfinex Analysts Query Investor Curiosity for XRP ETFs

The Customary Chartered government stated he expects XRP worth positive aspects to maintain tempo with Bitcoin worth development targets.

As indicated in a latest US Crypto News publication, the financial institution sees Bitcoin’s worth rising to $120,000 in Q2, $200,000 by the end of 2025, and $500,000 by 2028.

He forecasted the Ripple worth to rise to $8 by 2026, contingent on spot XRP ETF approvals within the US. This might represent a 260% surge above the present worth of $2.22.

“In actual phrases, XRP inflation is presently 6%, versus 0.8% for Bitcoin. As such, we goal the XRP-USD worth ranges of $5.50 at end-2025, $8.00 at end-2026, $10.40 at end-2027, $12.50 at end-2028 and $12.25 at end-2029,” Kendrick defined.

In the meantime, analysts at Bitfinex warning towards optimism, saying that investor curiosity in a US-based spot XRP ETF might not match that witnessed in Bitcoin ETFs.

“We count on restricted inflows into an XRP ETF as some buyers might select to broaden their publicity throughout obtainable crypto ETFs. Nonetheless it’s unlikely to see the extent of flows skilled by Bitcoin,” Bitfinex analysts informed BeInCrypto.

The contrasting assessments replicate broader uncertainty over how altcoin ETFs may carry out in a regulated US market.

Bitcoin’s dominance and changing regulatory attitudes towards digital belongings nonetheless closely affect the crypto market within the US.

Up to now, Grayscale, Wisdom Tree, Bitwise, Canary, and 21Shares have filed for XRP ETF approvals with the SEC. Bitwise’s utility obtained official acknowledgment on February 18, triggering several timelines for approving, denying, or extending the appliance.

The ultimate deadline is October 12, 240 days after official receipt. This date is equal to the ‘last deadline’ of January 10, 2024, for BTC ETF approvals, the day they had been permitted.

Nonetheless, with different functions past XRP ETF pending approval, together with Solana and Litecoin, Kendrick famous that different functions within the pipeline may have an effect on the timeline for XRP ETF approval.

“Litecoin appears more than likely to progress the quickest, offering early perception into how the brand new SEC management will deal with altcoin ETFs,” Kendrick stated.

As a hard fork of Bitcoin, Litecoin may already be considered by the SEC as a commodity slightly than a security. In response to Kendrick, its similarity to Bitcoin might make it conceptually simpler for buyers to grasp.

This aligns with Balchunas’ forecast that Litecoin ETF could take precedence over a Solana ETF.

“We count on a wave of cryptocurrency ETFs subsequent 12 months, albeit not all of sudden. First out is probably going the BTC + ETH combo ETFs, then in all probability Litecoin (as a result of it’s a fork of BTC, [therefore it’s a] commodity), then HBAR (as a result of it’s not labeled security), after which XRP/Solana (which have been labeled securities in pending lawsuits),” Balchunas stated.

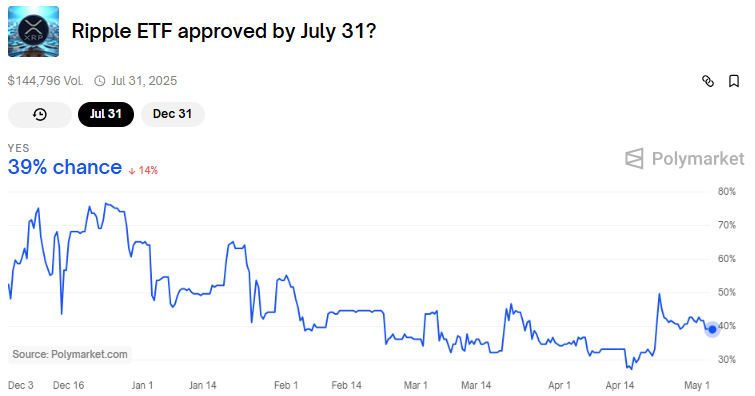

For now, knowledge on Polymarket exhibits a 39% probability that XRP ETFs shall be permitted by July 31 and a 79% probability by December 31.

Chart of the Day

The charts examine the NAV (Web Asset Worth) in USD for Bitcoin, Ethereum, XRP, Solana, and Litecoin by way of Bitwise ETPs and US spot ETFs.

Determine 12 (left) exhibits Bitwise ETPs, highlighting Bitcoin’s dominance, whereas Determine 13 (proper) focuses on US spot ETFs, with Bitcoin once more main.

Byte-Sized Alpha

Right here’s a abstract of extra crypto information to comply with right now:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of Could 1 | Pre-Market Overview |

| Technique (MSTR) | $381.60 | $391.45 (+2.58%) |

| Coinbase World (COIN) | $201.30 | $204.85 (+1.76%) |

| Galaxy Digital Holdings (GLXY.TO) | $24.05 | $26.39 (+9.72%) |

| MARA Holdings (MARA) | $14.05 | $14.29 (+1.71%) |

| Riot Platforms (RIOT) | $7.77 | $7.90 (+1.67%) |

| Core Scientific (CORZ) | $8.55 | $8.73 (+2.11%) |

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.