Why “Sell in May” Could Be a Huge Mistake in 2025

The outdated monetary market adage “Promote in Could and go away” has lengthy been a tenet for buyers seeking to keep away from potential summer time volatility. Nevertheless, some evaluation means that this adage could not maintain true for Bitcoin within the coming month.

A number of arguments point out vital variations available in the market panorama for 2025. These components counsel that Could might see value will increase as an alternative of decreases.

4 Causes Why Promoting in Could May Be a Large Mistake in 2025

Many analysts lately emphasised a key purpose: Bitcoin now aligns closely with the global M2 money supply.

M2 measures the amount of cash circulating within the financial system. It contains money, financial savings deposits, and extremely liquid belongings. Traditionally, M2 has proven a powerful correlation with Bitcoin costs. When central banks such because the FED, ECB, or PBoC improve the cash provide, Bitcoin tends to rise.

Kaduna shared a chart that confirms this development will proceed in 2025. In keeping with this sample, Could could possibly be a breakout month for Bitcoin. Whereas not all analysts agree with this view, buyers are more and more accepting it, creating optimistic sentiment available in the market.

“Promote in Could and go away could be an enormous mistake,” Kaduna emphasized.

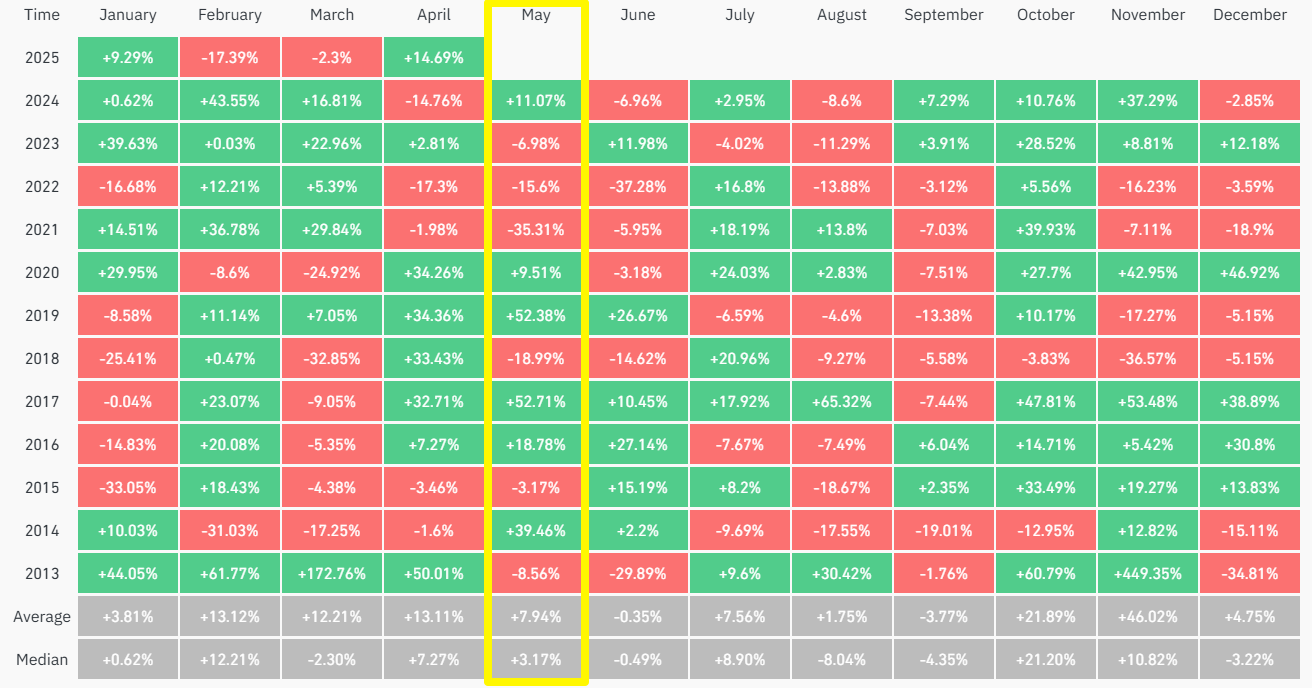

Second, historic information backs up Kaduna’s outlook. In keeping with Coinglass, Bitcoin has delivered a mean return of over 7.9% in Could over the previous 12 years. Though monetary markets usually expertise turbulence in summer time, Bitcoin doesn’t all the time comply with that sample.

As a substitute, Could usually exhibits optimistic efficiency. It’s not the strongest month, but it surely outperforms June and September. One investor on X observed that since 2010, Bitcoin has seen 9 inexperienced Mays and 6 pink ones.

The unique proverb comes from the inventory market, the place historic information exhibits it works higher for equities, not essentially for crypto.

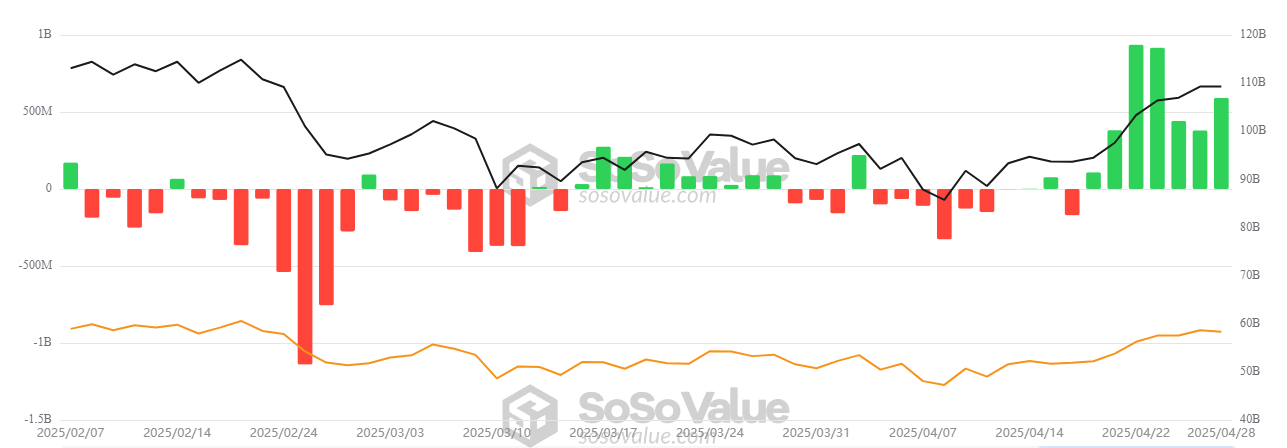

One other main level supporting Kaduna’s thesis is the surge in inflows into Bitcoin ETFs. BeInCrypto lately reported that spot Bitcoin ETFs attracted recent investor demand on Monday. They recorded internet inflows of $591.29 million and prolonged their successful streak to seven consecutive days.

Notably, BlackRock’s iShares Bitcoin Belief (IBIT) led the way in which. It recorded the most important influx amongst its friends, attracting $970.93 million in someday, bringing its whole accrued internet inflows to $42.17 billion.

This improve displays rising investor confidence and long-term optimism for Bitcoin in 2025. That sentiment could properly carry into Could, giving additional upward momentum to Bitcoin’s value.

Lastly, Bitcoin is clearly decoupling from the S&P 500, which traditionally has signaled giant value surges.

Investor arndxt famous this divergence. BeInCrypto additionally reported a rising disconnect between Bitcoin and the NASDAQ index. Bullish analysts interpret this as an indication that Bitcoin behaves extra like an impartial asset, much less tied to conventional markets.

“The outdated ‘Promote in Could and go away’ mantra doesn’t apply the identical means for crypto, liquidity pressures are easing, and this time, Could might mark the start of an acceleration, not a pause.” – arndxt predicted.

Robust assist from M2 correlation, optimistic Could efficiency in Bitcoin’s historical past, giant ETF inflows, and decoupling from conventional indexes counsel that promoting Bitcoin in Could 2025 could possibly be a critical mistake.

Nevertheless, buyers ought to stay cautious. Key information from the Fed, reminiscent of CPI, rates of interest, and updates on trade tensions, might nonetheless introduce uncertainty into Could’s outlook.

Disclaimer

According to the Trust Project pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

Source link